Whether you are a new startup or an established business, restructuring your company from a single to a dual structure can offer several benefits. These include:

- boosting protections for your business’ intellectual property (IP);

- providing more flexibility to launch related ventures; and

- enabling subsidiaries to assume extra business risk.

This article will explore what a dual company structure is, how to restructure from a single to dual company structure, and the advantages of restructuring.

What is a Dual Company Structure?

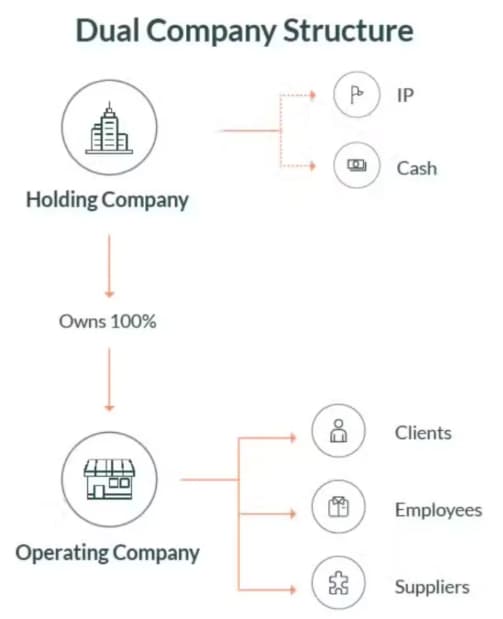

In a dual company structure, you have:

- a holding company that owns the valuable IP and assets of your business; and

- one or more operating companies, where the holding company owns 100% of the shares.

This structure operates on a parent-child relationship. The holding company acts as the parent, directing the subsidiary operating companies. The holding company owns the valuable IP and assets of the business, so the value primarily resides in its shares. The operating companies, on the other hand, serve as trading entities with comparatively lower value.

How to Restructure Your Single Company into a Dual Company Structure

When you are thinking about restructuring from a single company to a dual company structure, there are a few steps involved. Depending on what you need for your corporate restructure, these steps are likely to include:

New Holding Company

A new holding company is set up that is ‘clean’, meaning it does not carry any past business liabilities.

Share Exchange Agreement

Shareholders in the existing company ‘sell’ their shares in the existing company in consideration of receiving new (equivalent) shares in the holding company.

IP Assignment and Licence

The IP in the existing company is assigned or transferred to the new holding company, and the new holding company gives a licence or permission for the operating company to use the IP to enable the operation of the business.

Third-party Consents

When your company undergoes corporate restructuring, you need to think about whether you need consent from any third parties. Usually, contracts include restrictions on “change of control,” but they often exempt technical changes resulting from corporate restructuring (where there is no real change of control). However, if there is no such exemption, you will need consent from the other parties involved.

Tax and Accounting

Before you implement a corporate restructuring, you need to seek legal, tax and accounting advice on the restructuring. Tax advice is crucial to address the following:

- whether shareholders exchanging their shares in the existing company for shares in the holding company will face any tax implications;

- determining the assignment fee for the IP being transferred into the holding company; and

- determining the license fee for the operating company’s use of the IP.

Overall, the dual company structure is optimal from both a tax and accounting perspective, considering the specific context of your company contemplating the restructuring.

Legal Documents

It is crucial to make sure that your company’s decision to restructure is clearly outlined in its legal documents. You will need to prepare:

- a share exchange agreement;

- an IP Assignment and License Deed; and

- associated company resolutions as part of this process.

What Are the Benefits of a Dual Company Structure?

Asset Protection

The most significant advantage of a dual company structure is asset protection. In this setup, the holding company legally owns your business’ IP and valuable assets. This arrangement shields these assets from legal claims arising from contracts with suppliers or customers. The operating company handles all contractual obligations. So, if a claim arises, typically, the other party can only pursue the operating company rather than the holding company.

Division of Business Operations

A dual company structure also gives you greater flexibility to expand into different markets and opportunities. For instance, if you want to run stores in different geographical areas, you can easily set up separate companies for each area. Similarly, if you want to separate parts of your business, such as having one company provide services and another sell your core product, you can do so by establishing two different subsidiaries.

Dividing your business operations allows you to mitigate risk. For example, if one geographical location and store face business difficulties, you can liquidate the company running that store without impacting other parts of your business. Without this structure, the business difficulties of that one store would affect your entire business.

Investment

While it is optional to have a dual company structure when seeking investors, many sophisticated investors prefer it. They want assurance that your business has safeguarded its IP. A dual company structure is generally seen favourably by investors because it demonstrates a commitment to protecting their investment.

Essential reading for anyone building their startup. This free guide includes practical advice and seven real-life case studies.

Key Takeaways

Restructuring from a single company to a dual company structure brings several benefits to your business. This shift gives your business better protection for its IP and makes its corporate structure more flexible, guarding against risks. To make this change, your company needs to follow several steps. Before proceeding, you must seek advice from tax, accounting, and legal professionals.

If you have any questions about how to move to a dual company structure, our experienced business lawyers can assist as part of our LegalVision membership. For a low monthly fee, you will have unlimited access to lawyers to answer your questions and draft and review your documents. Call us today on 0800 005 570 or visit our membership page.

We appreciate your feedback – your submission has been successfully received.